Sono Bello is a popular cosmetic surgery provider specializing in body contouring, liposuction, and fat removal procedures. Many people turn to Sono Bello to achieve a more sculpted appearance or target stubborn fat areas. These procedures are elective, meaning they are chosen for aesthetic reasons rather than medical necessity. Patients often wonder whether insurance will cover the cost of such treatments..

Cosmetic surgery, by definition, is generally not covered by most health insurance plans. Insurance is designed to cover procedures deemed medically necessary to treat disease, injury, or functional impairment. Since Sono Bello procedures are elective, insurance rarely pays for them. Patients may still seek financing options, personal loans, or payment plans offered by the clinic. Planning ahead for costs is essential, as body contouring procedures can range from several thousand dollars to over $10,000.

While Sono Bello provides safe and effective cosmetic procedures, coverage through insurance is exceptional and limited. In rare cases, if a procedure is medically necessary to treat a condition such as lipomas, reconstructive surgery, or post-weight loss excess skin causing functional issues, insurance may consider coverage. Patients must provide detailed medical documentation, physician recommendations, and proof of medical necessity.

Table of Contents

Understanding Sono Bello Procedures

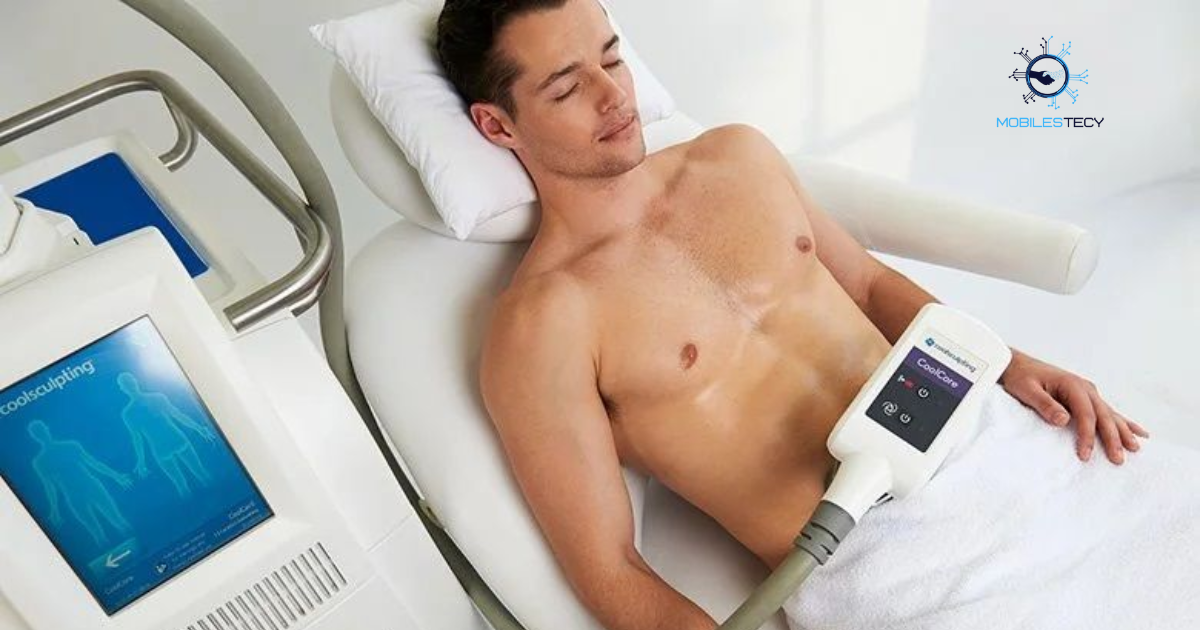

Sono Bello specializes in minimally invasive body contouring procedures using laser-assisted liposuction. These treatments target stubborn fat deposits that are resistant to diet and exercise. Common areas include the abdomen, thighs, arms, and chin. Procedures are typically outpatient and involve local anesthesia combined with mild sedation. Laser technology promotes skin tightening while removing fat cells for a smoother, natural appearance.

Sono Bello offers different packages, including the MiniTuck, MicroLipo, and FacialLipo, depending on the area and extent of treatment. These procedures are tailored for aesthetic goals rather than medical needs. Recovery is usually short, with patients returning to normal activities within days or weeks. Results can vary depending on the patient’s age, lifestyle, and body composition.

Patients considering Sono Bello should consult with licensed providers to discuss expectations and risks. Risks include infection, bruising, swelling, asymmetry, or minor skin irregularities. A thorough preoperative evaluation ensures patients are medically fit for elective surgery. Clinics provide detailed pricing, financing options, and pre- and post-operative care instructions. Patients must understand the elective nature of procedures and the limited role of insurance coverage.

Insurance and Cosmetic Surgery Coverage

Health insurance policies generally cover procedures only if they are medically necessary. Elective cosmetic procedures like those offered by Sono Bello typically do not qualify. Insurance companies may require documentation proving that a procedure corrects a deformity, functional impairment, or medical condition.

Medical necessity must be clearly documented by a physician for insurance consideration. This includes physician notes, diagnosis codes, and detailed explanations of functional limitations. Preauthorization may be required before insurance agrees to cover even partial costs. Patients should contact their insurance company directly to clarify coverage policies for body contouring procedures.

Financing Options and Out-of-Pocket Costs

Since Sono Bello procedures are generally not covered by insurance, patients often rely on alternative financing. The clinic offers payment plans that allow patients to spread the cost over months. Personal loans, credit cards, and medical financing companies are other options. Patients should evaluate interest rates, repayment terms, and total cost when choosing financing. Understanding these options ensures patients can undergo treatment without undue financial stress.

The total cost of Sono Bello procedures varies depending on the treatment area, number of areas treated, and geographic location. Smaller treatments like MicroLipo can cost a few thousand dollars, while full-body contouring packages may exceed $10,000. Costs include anesthesia, facility fees, post-operative care, and follow-up visits. Patients should consider these factors when evaluating their budget and financing options.

Some patients explore Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) to offset costs. These accounts allow use of pre-tax dollars for medical procedures if deemed eligible. Documentation of medical necessity may be required even for HSA or FSA use. Patients should consult tax and financial advisors to maximize benefits. Combining financing options with savings accounts can make Sono Bello procedures more affordable.

When Insurance May Partially Cover Procedures

Insurance may sometimes cover procedures if they are reconstructive rather than purely cosmetic. Examples include post-weight loss skin removal or correction of asymmetry after trauma. Coverage requires documentation proving medical necessity and functional impairment. Prior authorization from insurance companies is almost always required..

Some plans cover preoperative evaluations, lab tests, or related medical procedures associated with surgery. These benefits may slightly reduce overall costs. Postoperative complications may also be covered if treatment is medically necessary. Patients should verify coverage details before scheduling procedures to avoid unexpected bills.

Tips for Patients Considering Sono Bello

Research your insurance policy carefully before scheduling Sono Bello procedures. Determine whether your plan covers any part of cosmetic or reconstructive procedures. Consult a licensed provider to evaluate medical necessity and discuss alternative options if coverage is required. Consider financing plans, HSAs, FSAs, or personal loans to manage costs. Keep detailed documentation of consultations, physician recommendations, and insurance communications.

Patients should also consider alternative clinics or procedures that may be covered under insurance. Some reconstructive surgeons may provide similar results with partial insurance coverage. Understanding the difference between elective and medically necessary procedures is essential. Ask providers about package costs, included services, and follow-up care. Review payment policies carefully before scheduling surgery.

Being informed about coverage policies ensures patients plan financially and avoid unexpected expenses. Proper financial and procedural planning enhances the overall treatment experience. Clear communication with providers and financial planning ensures smooth recovery and satisfaction with results. Elective cosmetic procedures can be achieved effectively when patients plan carefully for coverage and costs.

Key Considerations for Coverage and Costs

Patients must understand that Sono Bello procedures are primarily elective and rarely covered by insurance. Documentation proving functional impairment or medical necessity is required for any potential coverage. Financing options, HSAs, FSAs, and personal loans are the most common ways to pay for treatment.

Even when partial insurance coverage is possible, patients should prepare for out-of-pocket costs. Elective procedures are excluded from most policies, so personal payment planning is crucial. Comparing costs among clinics and exploring alternative financing reduces financial burden. Understanding limitations prevents surprises and allows patients to focus on recovery.

- Sono Bello procedures are generally elective and rarely covered by insurance.

- Insurance may cover procedures deemed reconstructive or medically necessary with documentation.

- Financing options, HSAs, FSAs, or personal loans help manage costs effectively.

- Preoperative and postoperative care may be partially covered if medically required.

- Planning ahead ensures realistic expectations and reduces financial stress during recovery.

Faq’s

Does insurance cover Sono Bello procedures?

Generally no, as these procedures are elective and cosmetic in nature.

Can insurance cover Sono Bello for medical reasons?

Yes, but only if documented as medically necessary for functional impairment.

Are payment plans available for Sono Bello procedures?

Yes, the clinic offers financing options to spread costs over months.

Can HSAs or FSAs help pay for Sono Bello procedures?

Sometimes, if medical necessity is documented; check plan eligibility carefully.

Are pre- and post-operative services covered by insurance?

Only if deemed medically necessary; otherwise, patients pay out-of-pocket.

Conclusion

Sono Bello procedures are elective cosmetic treatments designed to improve body contour and appearance. Most health insurance plans do not cover elective cosmetic surgery, including body contouring and liposuction. Coverage may be possible in rare cases when procedures are medically necessary or reconstructive. Financing options, HSAs, FSAs, and personal loans are commonly used to manage costs.

Patients considering Sono Bello should document any medical necessity to explore partial insurance coverage. Coordination with providers and insurance representatives increases chances of approval for reconstructive cases. Understanding financing options, payment plans, and savings accounts can make procedures more affordable. Patients should research procedures thoroughly and discuss risks, benefits, and realistic outcomes with providers.

Even when insurance does not cover procedures, careful planning allows patients to achieve desired results responsibly. Comparing financing options and understanding package costs reduces financial stress. Awareness of insurance limitations, potential coverage, and out-of-pocket expenses ensures informed decision-making. Patients benefit from improved aesthetics and confidence with proper preparation and planning.

Read more latest Articles on Mobilestecy.com