AmeriHealth insurance cards contain several important numbers for plan identification. The AmeriHealth card includes the group number, member ID, and policy details. Each set of numbers allows providers to verify insurance coverage accurately. The group number specifically connects enrollees to their employer or organization. Without these identifiers, claims processing would become significantly delayed.

AmeriHealth insurance through employer-sponsored and individual marketplace plans. Employer plans typically assign a unique group number for employees. This group helps AmeriHealth organize billing, eligibility, and policy rules. Individual plans may not always include group numbers, depending on policy type. Differences between group and member identification often confuse new policyholders.

Healthcare providers require accurate information before scheduling appointments or treatments. The group number helps determine specific benefits and covered services. It also identifies cost-sharing responsibilities and network restrictions. Members presenting incomplete information may face unexpected delays or denial. Understanding insurance card components reduces confusion during health-related decisions.

Table of Contents

What the Group Number Represents

The group number on AmeriHealth cards refers to an employer plan. Employers negotiate benefits, coverage levels, and cost-sharing arrangements. AmeriHealth assigns a unique numeric group identifier for each organization. Providers use this group code to verify plan-specific benefits. Group contracts reduce administrative burden and streamline health insurance. Employees share benefits under a single organized policy structure.

Group numbers structure how claims are processed and billed internally. When doctors submit claims, they include both member IDs and group codes. These inform AmeriHealth how to calculate payments and deductibles properly. Without a group number, employer plan claims could be misrouted. Misrouted claims cause significant delays in reimbursement or medical approval. Proper identification ensures faster claim adjudication and accurate billing.

Not all AmeriHealth plans have a group number visible on the card. Marketplace or individual policies may rely only on a member ID. In those cases, providers verify benefits using alternative identifiers. Group numbers are most common with employer-sponsored AmeriHealth plans. Knowing whether a plan is group-based clarifies how benefits apply. Members should inspect their cards to confirm plan type and structure.

Difference Between Group Number and Member ID

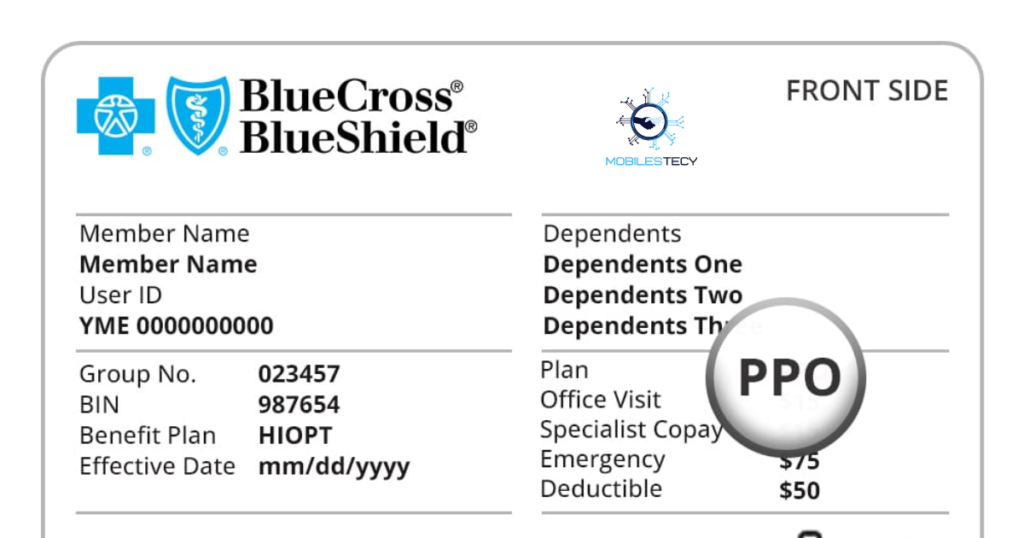

Member IDs identify individual policyholders, not entire employer groups. Each insured person receives a unique identification number. Providers use this ID for eligibility and claim filing purposes. In contrast, group numbers connect multiple employees under one policy. Both identifiers are crucial for accurate insurance administration.

Group numbers organize employer contracts, while member IDs verify individuals. Misunderstanding these numbers may cause claim submission errors. Providers typically request both numbers during appointment scheduling. AmeriHealth uses these identifiers to separate financial and eligibility tasks.

Why the Group Number Matters for AmeriHealth Insurance Members

The group number ensures accurate benefit application for employer-sponsored plans. Benefits vary across organizations, industries, and negotiated packages. Deductibles, copays, and network access often differ between groups. Providers rely on this number to determine how much patients owe. A missing or incorrect group code disrupts cost-sharing calculations entirely. This can lead to surprise billing or incorrect benefit application.

Group numbers also matter during transitions between employers. Changing jobs often requires switching to a new group plan. Members must update providers with new AmeriHealth group information. Failure to update records may result in denied coverage. Insurance systems do not automatically recognize outdated plan data. Keeping provider files current prevents claim and coverage complications.

Understanding group numbers empowers members during healthcare planning. Knowing coverage rules influences provider selection and treatment decisions. For example, employers may negotiate exclusive network arrangements. Members unaware of network differences risk higher out-of-pocket expenses. Group-based coverage clarity helps families avoid financial surprises. Knowledgeable members navigate AmeriHealth benefits more confidently and efficiently.

How Providers Use the Group Number

Providers confirm plan eligibility using group numbers during check-in. This determines covered services, copays, and deductible responsibilities. Hospitals rely heavily on accurate group identification before procedures. Accurate verification reduces billing disputes after treatment completion. Administrative efficiency depends on correct insurance card data.

Pharmacies and specialists may require group numbers for benefit checks. Certain AmeriHealth formularies differ between employer groups. Group identification ensures accurate prescription drug pricing. Coordination between providers and insurers prevents claim rejections. Group numbers support smoother patient and billing experiences overall.

Finding, Using, and Updating Group Numbers

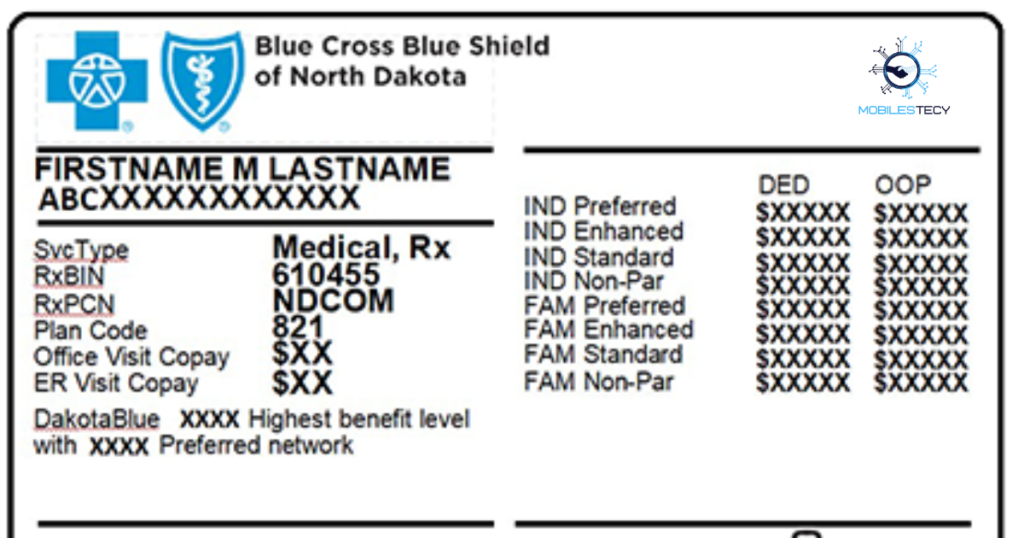

The group number usually appears near the member ID on AmeriHealth cards. Labeling may vary slightly by plan type and card format. Cards issued through employers consistently display the group code. Individual marketplace cards may omit the number entirely. Members can confirm group details by contacting AmeriHealth support. Employers also provide documentation explaining plan identifiers.

Members must present accurate card data during healthcare interactions. Electronic medical systems store group numbers for future visits. If cards change, outdated information must be replaced quickly. AmeriHealth updates cards after open enrollment or employment changes. New coverage terms may adjust deductibles or formularies. Updated group numbers ensure benefits align with current policy contracts.

Contacting AmeriHealth is necessary when group numbers require corrections. Typographical errors occasionally cause eligibility verification issues. Members should monitor updates after employment transitions. Providers must re-verify eligibility when plans renew annually. Ensuring accuracy prevents financial errors and claim denials. Insurance literacy improves health and financial outcomes substantially.

Common Confusion About Group Numbers

AmeriHealth Insurance members sometimes confuse policy numbers with group numbers. Policy numbers apply to insurance contracts across multiple years. Group numbers apply only to employer-specific benefit arrangements. Clarifying distinctions prevents administrative misunderstandings. Insurance representatives can resolve confusion quickly when asked.

Another confusion arises among marketplace members lacking group codes. Individual plans operate without group structures entirely. Providers confirm these plans using alternative identifiers. Absence of a group number does not affect coverage validity. Marketplace members receive full benefits without employer grouping.

• Group numbers link members to employer-sponsored AmeriHealth plans

• Member IDs identify individuals for eligibility and claim filing

• Group codes determine specific cost-sharing and benefit structures

• Marketplace individual plans may not display group numbers

• Updating group information prevents claim denials and billing issues

Faq’s

What is a group number on an AmeriHealth insurance card?

It links members to an employer-sponsored insurance plan. Providers use it for billing and benefit determination.

Do individual AmeriHealth insurance plans have group numbers?

Not always, as marketplace plans may rely only on member IDs. Benefits remain valid without employer grouping.

Is the group number the same as my member ID?

No, group numbers apply to employer plans, while member IDs identify individuals. Both may appear on the card.

Why does my doctor ask for my AmeriHealth insurance group number?

Providers verify benefits, copays, and formularies using group codes. Accurate information speeds claim and billing processes.

Where can I find my AmeriHealth insurance group number if it’s missing?

Contact AmeriHealth or your employer’s HR department for confirmation. Updated cards may also include the required number.

Conclusion

The group number on an AmeriHealth insurance card plays a crucial administrative role. It connects members to employer-sponsored plans with tailored benefits. Providers rely on group codes to verify eligibility and coverage details. Understanding group numbers helps navigate healthcare confidently. Members benefit from fewer billing errors and denied claims. Insurance literacy remains essential in modern healthcare systems.

Employer groups negotiate unique insurance terms and cost structures. Group numbering helps insurers manage policy pricing across industries. Employees sharing a group code share coverage rules and responsibilities. Marketplace individuals operate without employer structuring. These distinctions influence plan design and benefit distribution. Awareness supports informed decision-making and smoother medical access.

AmeriHealth members should review their cards for accurate information. Updating group data ensures proper claim processing and provider billing. Contacting employers or AmeriHealth resolves missing code issues quickly. Members who understand card components experience fewer administrative problems. Better knowledge reduces confusion at pharmacies, clinics, and hospitals. Insurance clarity improves health and financial outcomes for all policyholders.

Read more latest Articles on Mobilestecy.com