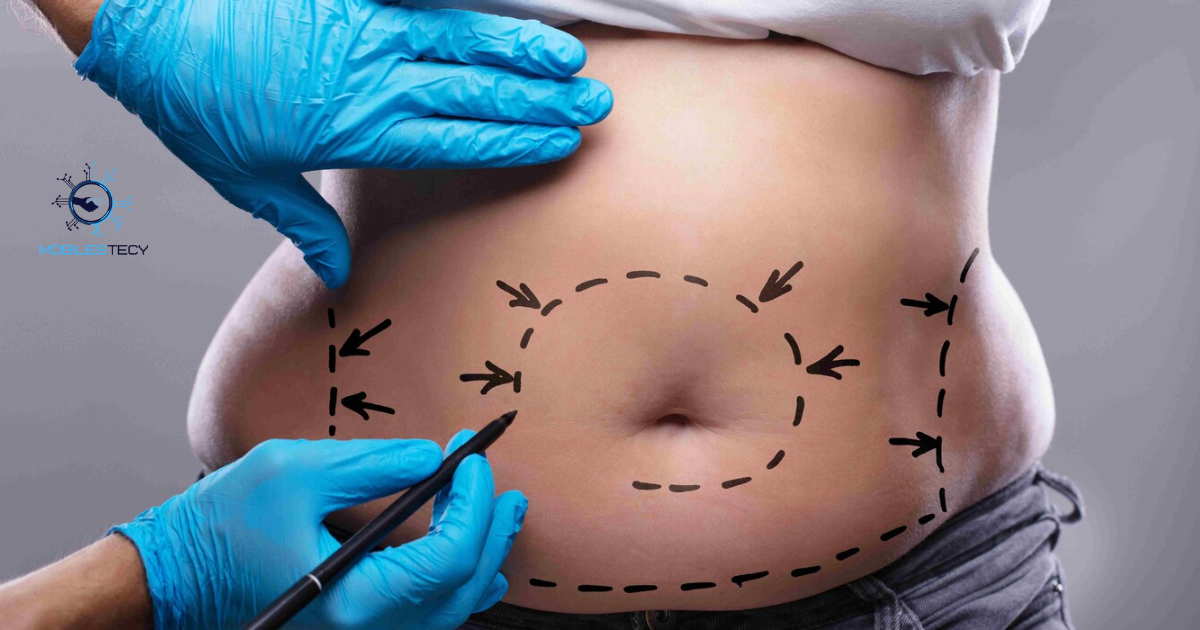

Tummy Tuck is a surgical procedure designed to remove excess skin. Many people consider it for aesthetic reasons and body contouring purposes. Health insurance coverage for this procedure is rarely granted automatically. Insurance companies typically classify it as a cosmetic elective surgery procedure. Understanding coverage rules helps patients avoid unexpected medical and financial surprises. Patients often assume insurance will cover costs without verification.

In some cases, parts of the surgery may qualify as medically necessary. Patients with functional impairments or chronic skin conditions may be exceptions. Insurers usually require detailed documentation from a qualified medical professional. Coverage decisions vary between private insurance, Medicare, and Medicaid policies. Knowing criteria in advance can prevent unnecessary frustration and wasted time.

This article explores when health insurance might cover tummy tuck procedures. It explains the differences between cosmetic and medically necessary surgical procedures. Readers will understand insurance requirements, documentation needs, and common denial reasons. Alternative financial options are also discussed for patients without coverage. Being informed helps patients plan effectively for surgical interventions.

Table of Contents

Understanding Cosmetic vs Medically Necessary Surgery

Most health insurance plans cover medically necessary procedures defined by function or disease. Cosmetic surgeries, including standard tummy tucks, are usually excluded from coverage. The procedure is considered elective if primarily intended to improve appearance. Insurers often deny claims for elective cosmetic procedures without medical justification. Patients should understand policy language regarding exclusions and covered conditions.

Medical necessity requires a condition that affects health or daily functionality. Examples include chronic skin infections, mobility restrictions, or hernia repairs. Documentation must prove that the surgery is required for functional improvement. Surgeons must provide evidence that non-surgical treatments were ineffective previously. Insurers evaluate claims on a case-by-case basis, reviewing submitted clinical evidence.

Even if medically necessary conditions exist, full tummy tuck coverage may be denied. Insurers often only cover the medically required portion of the procedure. Cosmetic enhancements beyond that portion are generally excluded from reimbursement. Patients should discuss detailed coverage possibilities with both surgeons and insurers. Careful planning ensures realistic expectations for costs and benefits. Patients sometimes need to appeal initial denials successfully.

Situations Where Insurance Might Cover

Insurance may cover panniculectomy if excess abdominal tissue causes medical issues. Examples include chronic infections, persistent rashes, and skin breakdown in folds. Documentation must demonstrate repeated failed conservative treatments such as topical therapy.

Coverage may also apply if a hernia or defect requires repair. Surgeons performing corrective surgery may combine functional repair with tissue removal. Insurers usually require detailed clinical records and prior authorization for approval. Coverage is limited to medically necessary procedures and excludes cosmetic enhancements.

Coverage Criteria and Documentation Requirements

Prior authorization is typically required before any insurance consideration for surgery. Surgeons submit a medical necessity letter explaining functional impairments tummy tuck and surgical justification. Detailed records, including photographs, clinical notes, and treatment history, strengthen claims. Insurance companies review documentation against policy language and plan requirements. Approval depends on meeting strict medical necessity criteria defined by insurers. Patients should include previous treatment attempts and progress notes.

Patients should demonstrate conservative treatment attempts before surgery is approved. Documentation may include topical treatments, physical therapy, or other non-surgical interventions. Insurers require proof that conservative management failed before authorizing surgery. The more detailed and precise the documentation, the higher approval likelihood. Accurate submissions prevent unnecessary claim denials and delays.

Cost-sharing policies often apply even when tummy tuck coverage is granted by insurance. Deductibles, co-pays, and coinsurance amounts may be patient responsibilities. Coverage typically excludes cosmetic enhancements beyond the medically necessary portion. Patients should clarify coverage details, including limits and exclusions, with their insurer. Understanding financial obligations avoids surprises after surgical procedures.

Medicare and Medicaid Considerations

Medicare generally does not cover cosmetic abdominoplasty procedures for aesthetic purposes. Exceptions occur only in cases of documented medical necessity and functional impairment. Prior authorization and supporting medical documentation are essential for coverage consideration.

Medicaid coverage varies by state and plan; most exclude elective cosmetic surgery. Some states may approve coverage for functional impairments or chronic skin problems. Local Medicaid offices provide specific guidance on documentation and eligibility requirements.

Financial Options for Uncovered Surgery

Since most tummy tucks are cosmetic, many patients pay out of pocket. Costs typically range from several thousand to over ten thousand dollars. Payment plans may be offered by surgical centers to facilitate affordability. Medical financing options are available through third-party lenders or credit programs. Personal loans can also provide funding for elective procedures. Patients should evaluate interest rates and repayment schedules carefully.

Patients may explore combination approaches to reduce costs, such as partial procedures. Discussing surgery scope with the surgeon may minimize unnecessary expenses. Some surgeons offer discounts for multiple procedures performed together. Comparing different facilities helps identify competitive pricing and quality outcomes. Financial planning ensures patients can pursue surgery responsibly.

Being informed about costs and coverage helps set realistic expectations. Understanding limitations of insurance reduces stress during planning and recovery. Patients can make better decisions by considering all financial options. Proper planning prevents unexpected financial strain during the surgical process. Knowledgeable patients experience improved satisfaction with surgical outcomes.

Practical Tips for Patients Seeking Coverage

Work with your surgeon to provide thorough medical documentation for insurers. Include photographs, clinical notes, and treatment history for better approval chances. Submit all records in an organized and detailed manner. Follow up regularly to ensure insurance received and reviewed documents.

Request prior authorization before scheduling any procedures to prevent coverage denial. Keep copies of all submitted documents and insurer communications for reference. Track progress and maintain clear communication with medical providers. Be proactive to increase chances of successful approval.

• Standard tummy tuck procedures are generally considered cosmetic and not covered.

• Panniculectomy may be covered if medical issues are documented effectively.

• Insurers require prior authorization and detailed medical necessity documentation.

• Medicare and Medicaid usually exclude elective abdominoplasty unless criteria are met.

• Financial planning is essential for procedures not covered by insurance.

Faq’s

Does health insurance cover a tummy tuck procedure?

Usually no, because it is classified as cosmetic rather than medically necessary. Coverage may be possible in rare documented functional cases.

When might insurance cover a tummy tuck?

Coverage may apply if excess skin causes chronic infections or functional problems. Strong evidence and medical records are required for approval.

Is prior authorization required for coverage consideration?

Yes, insurers generally require detailed documentation and prior authorization approval before surgery. Submission ensures claims are evaluated appropriately.

Does Medicaid ever cover abdominoplasty procedures?

Coverage varies by state; some may approve medically necessary panniculectomy procedures. State-specific rules must be verified in advance.

Are cosmetic enhancements covered if medical necessity is approved?

No, only the portion required for functional improvement is typically reimbursed. Cosmetic components must be paid out of pocket.

Conclusion

Health insurance generally does not cover tummy tuck because they are cosmetic procedures. Exceptions exist for medically necessary cases such as functional impairments or severe skin infections. Approval depends on detailed documentation, prior authorization, and insurer review. Patients should communicate closely with both their surgeon and insurance provider. Being informed ensures realistic expectations regarding coverage and costs.

Panniculectomy or medically required tummy tuck tissue removal may qualify for insurance coverage. Coverage decisions are specific to each policy, insurer, and medical evidence submitted. Patients must demonstrate functional impairment or chronic medical problems to meet criteria. Even with documentation, cosmetic portions are excluded from reimbursement. Understanding requirements helps patients plan financially and medically for surgery.

Financial planning is essential when insurance coverage is unavailable. Payment plans, personal loans, and medical financing can reduce upfront costs. Comparing surgeons and facilities ensures both quality outcomes and affordable options. Knowledgeable patients experience less stress during preoperative planning and postoperative recovery. Being proactive increases chances of successful outcomes and patient satisfaction.

Read more latest Articles on Mobilestecy.com